- Lose wasteful expenses

- Earmark fund a variety of needs (as well as the next house)

Once you learn how much cash you can afford to keep for every single times, you can even automate people savings which have transfers into the a faithful membership. This is certainly also known as a sinking fund, the place you consistently spend less for 1-out-of or unpredictable expenditures.

dos. Downsize your expenditures

After you have a spending plan positioned, you might pick areas where you might be in a position to slim the fat. From the reallocating that cash to the your house coupons, you happen to be in a position to pick a property also sooner.

- To buy activities at a discount or perhaps in bulk

- Restricting fun spending particularly eating out at dinner or buying the newest attire (remember: it is simply short term)

- Discussing specific tips and you can products having family (such memberships)

- Taking advantage of free services and products (such as for example downloading 100 % free ebooks out of your people collection unlike buying the most recent headings)

- Settling down recurring expenses (think: contacting the cord, sites, and you can insurance companies observe what discounts or straight down-cost arrangements could be offered)

Reducing your spending was scarcely fun, nonetheless it will save you a lot of money 1 month if the done properly. This will significantly help to your their homebuying plans.

step 3. Pay back personal debt

Debt are costly and you will keep your back off their financial wants. Paying large-attract personal debt would be a priority, says Jamie Curtis, a global a home advisor at the Sotheby’s Global Realty. This is exactly particularly important getting higher-notice costs eg handmade cards, which can have interest rates really to the double digits.

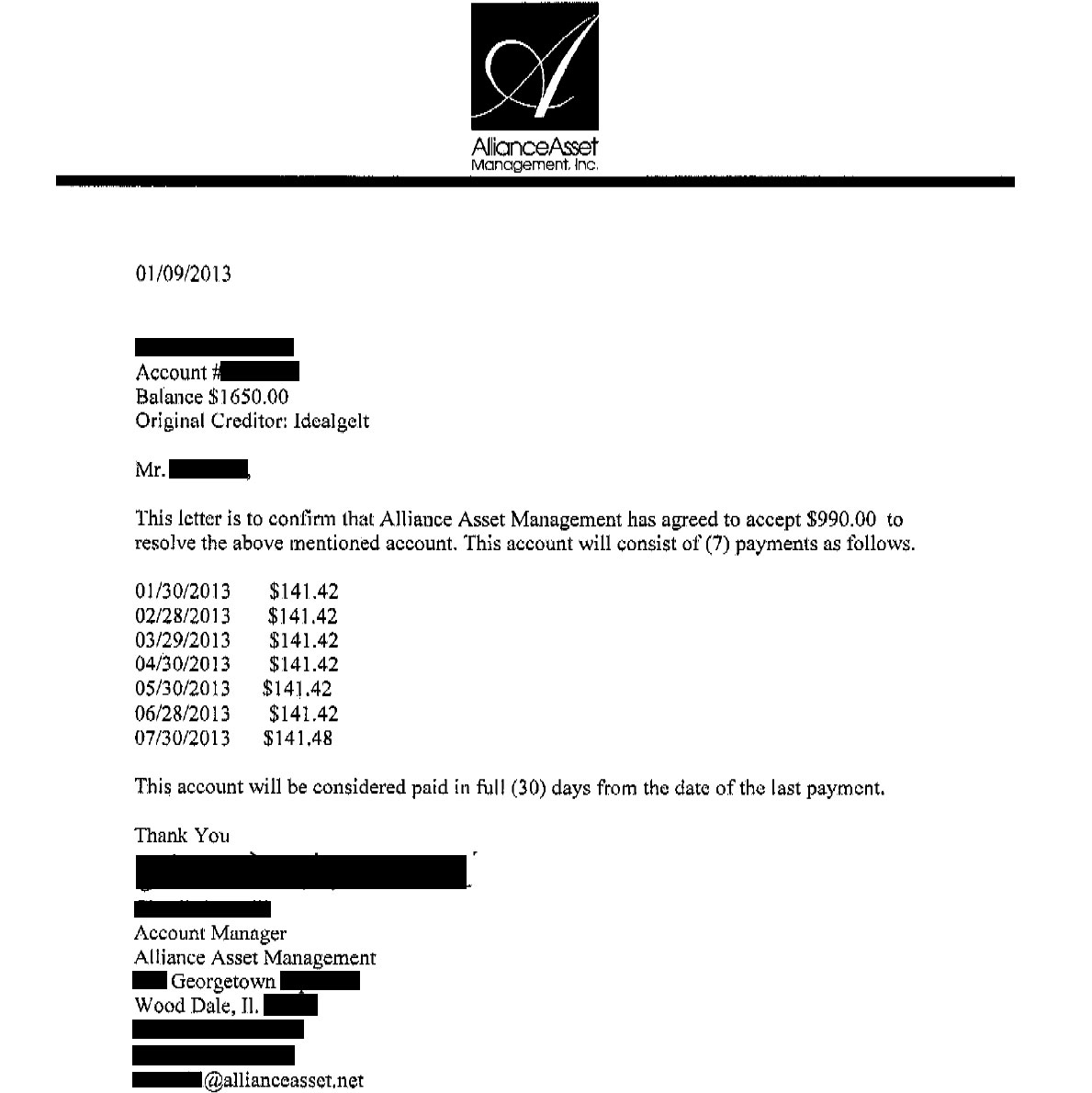

If the an amount of installment loans online in Minnesota month-to-month income is going to large-focus financial obligation, imagine focusing on paying the balance earliest. Of the refinancing otherwise reducing such expense, you might possibly help save plenty a-year, which you’ll after that allocate with the your property savings.

- Moving credit card balance so you can a credit with a great 0% Apr equilibrium transfer give

- Refinancing car, individual, or private college loans in order to a lowered interest

- Taking right out a consumer loan in order to consolidate highest-appeal bills

Either, reducing your house costs isn’t really sufficient. Otherwise may possibly not be reasonable. Seeking a method to earn more income is even of use, so there are ways to do it.

Very first, thought asking for a raise. If you were on your updates for a time instead of a keen rise in pay, and you will make a situation (maybe you recently attained a giant milestone or helped the firm spend less), then it the greatest route. You might also consider asking for an advertising when you are happy to take on a lot more commitments or spots in exchange for large shell out.

If the workplace rejects their demand or there isn’t area for the this new cover a wages increase, you might want to select a different job one to pays a great deal more. The new Pew Search Center unearthed that 63% from U.S. staff who leftover its services in 2021 did so on account of the latest spend. And you will sixty% from workers just who changed employers between knowledgeable an increase in wages.

5. See other ways to earn

Aside from your day employment, there are also a way to amplify your revenue (and you may improve your coupons services) on the side.

Trying out a part hustle is continuing to grow in dominance for the previous ages. In the 10% regarding pros today claim that he’s a side gig inside the introduction on the number one work. To earn additional money, think trying out a supplementary region-time business, creating self-employed works, monetizing your own passion, if not renting out your vehicles otherwise a room on your own domestic. Just be sure one to all you prefer wouldn’t expose a conflict of great interest otherwise violation one noncompete arrangements you finalized along with your newest manager.