In the case of fixed assets, these refer to assets that are not intended for resale. Examples include land and buildings, plant and machinery, and furniture. Financial assumptions are the key inputs and drivers that the difference between gross and net lease determine the outputs and results of a… This first piece of info has too much influence on their decision, which can prevent them from adjusting their plans when new, more accurate information comes along.

- A financial advisor for budgeting can help spot these biases, providing an objective viewpoint that ensures investment decisions align with company goals.

- What makes this difficult is we need to avoid falling into the “Results Oriented Thinking” trap.

- At the end of the six years, the machine has a $24,000 trade-in value.

- The issue with the size problem is related to IRR’s focus on rate of return instead of value generation in terms of dollars.

- Corporate governance plays a vital role in capital decision-making.

What is Capital Budgeting? – Definition, Process & Techniques

The cash flows at the earlier stages are better than the ones coming in at later stages. The company may encounter two projections with the same payback period, where one depicts higher cash flows in the earlier stages/years. While most big companies use their own processes to evaluate projects in place, there are a few practices that should be used as “gold standards” of capital budgeting. A fair project evaluation process tries to eliminate all non-project-related factors and focuses purely on assessing a project as a stand-alone opportunity.

The decision rule should acknowledge the time value of money concept

The issue with the size problem is related to IRR’s focus on rate of return instead of value generation in terms of dollars. Consider a situation where you had the choice of two projects. Project A cost $1 today and would return $2 at the end of 1 year. Project B cost $1000 and will return $1500 at the end of 1 year. The first project has a 100% IRR while the second project only has a 50% IRR. However, if you could only take one of these two projects, which would be better?

Financial Services: Types, Features, Importance, Characteristics

They also invest in technology to improve online shopping experiences. The challenge is to choose investments that will increase sales. For instance, a new factory will need significant funding, equipment, and a workforce. U.S. Treasury bonds have risk-free rates as they are guaranteed by the U.S. government, making it as safe as it gets.

Additionally, this method only considers the initial investment and the annual net cash inflows. This method does not consider other cash inflows or cash outflows, such as any salvage value for the project at the end of its useful life. ARR is another capital budgeting accounting method that compares a project’s expected average revenue to how much money the organization invested to make it all happen. Unlike other capital budgeting methods, ARR does not consider cash flow or the time value of money.

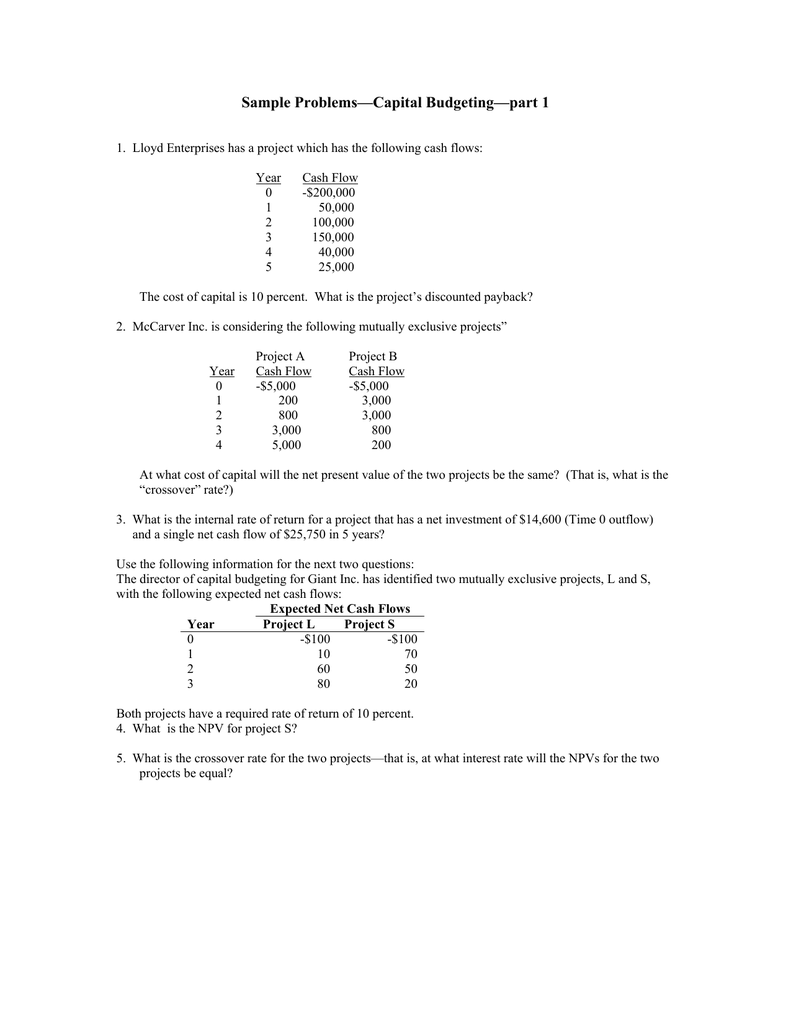

One of the most common and challenging problems in capital budgeting is how to avoid biases in decision making. Biases are mental shortcuts or heuristics that can lead to errors or distortions in evaluating and selecting capital projects. Biases can affect both the cash flow estimates and the discount rate used in the net present value (NPV) analysis. Biases can also influence the choice of the evaluation method, such as NPV, internal rate of return (IRR), payback period, or profitability index.

Other interdependent projects are substitutes in which the cash flows from both projects taken together are less than the cash flows from each project on a standalone basis. While we will not be evaluating interdependent projects in this class, the procedure is to look at each project individually as well as in combination. The IRR method simplifies projects to a single return percentage that management can use to determine whether or not a project is economically viable. A company often has an internal required rate of return to benchmark against and may decide to move forward with a project if the IRR exceeds this benchmark. On the other hand, a company may want to reject a project if it falls below that rate or return or it projects a loss over a period of time.

The process focuses on future cash flows rather than past expenses. This technique is interested in finding the potential annual rate of growth for a project. Generally, the potential capital projects with the highest rate of return are the most favorable. An acceptable standalone rate is higher than the weighted average cost of capital. If a business owner chooses a long-term investment without undergoing capital budgeting, it could look careless in the eyes of shareholders.