Sum of the years’ digits depreciation is the type of depreciation method that allocates the higher cost of the fixed assets in the early year and reduces the depreciation expense in later years as time passes. The company can calculate sum of the years’ digits depreciation after furloughed due to the coronavirus here’s what you need to know determining the expected useful life of the fixed asset and the depreciable cost to use as a basis of calculation. Sum of the years’ digits depreciation uses the assumption that the benefits that the company receives from the fixed asset will go down through the passage of time.

Depreciable Cost: What is & How To Calculate?

The sum of years’ method matches the cost of utilizing an asset and the overall utility of the asset across the economic or useful life of the asset. A major benefit of using this method is that it considers the fact that the asset performance will decline over the years; i.e. the asset is more productive in the early years. Therefore, it is only apt to charge a higher depreciation in the early years and decrease it in later years.

- Consider coffee company Mega Coffee, which is ready to expand into its new office headquarters.

- The depreciation schedule using sum-of-the-years’ digits for equipment is shown below.

- 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

- For example, if you buy an asset for $100,000 and it can be sold for an estimated $10,000 at the end of its useful life, the balance subject to depreciation is $90,000, and the salvage value is $10,000.

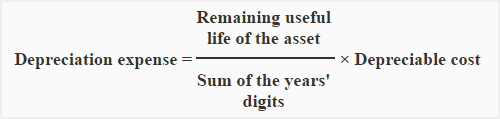

- The fraction’s denominator is the sum of the years’ digits, while the numerator is the number of years remaining in the asset’s life at the start of the year.

Services

An asset’s depreciation base is its initial cost, minus any salvage or residual value at the end of its useful life. CCC just acquired a truck for $60,000 and estimates that the truck will be useful for 6 years with a remaining salvage value of $5,000. Hence, for an asset that has a useful life of 4 years, the un-depreciated useful life to be used in calculating depreciation shall be 4 years in the first year of depreciation, 3 years in the second year and so on. Un-depreciated useful life is equal to the number of years in the asset’s useful life that have not yet been subjected to depreciation.

Understanding Sum-of-the-Years’ Digits

The only guideline is that the depreciation method should be systematic and rational, and as we noted, all of the depreciation methods discussed so far meet this requirement. Partial-year depreciation also can be calculated using the sum-of-the-years’ digits method. As with the double-declining-balance method, the sum-of-the-years’ digits method allocates more depreciation in the early years and less in later years. The advantages and disadvantages of this method are more or less the same as the declining balance method. Depreciation is calculated under sum-of-the-years’ digits by adding up the number of years in an asset’s useful economic life. An asset is purchased on 1 July 2020 and has an estimated useful life of 6 years.

In short, depreciation cost calculation is not simply about adding another expense entry into your accounting records. Instead, depreciation cost accounting enables you, as a business owner or executive manager, to understand how your assets depreciate to control your asset expenses and, importantly, gain tax benefits. Many companies calculate their depreciation expense using an accounting method called accelerated depreciation. In this depreciation scenario, an asset, such as a piece of equipment, has its book value reduced on the balance sheet at a faster rate than a traditional straight-line depreciation method. Companies use a few different methods for achieving this, such as the Sum of Years’ Digits (SYD) method. Sum of years is an accelerated depreciation method suitable for assets that lose most of their value in the early years of service.

What is your current financial priority?

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. It starts with the value n in the first year and decreases by 1 each year until it equals 1 in the final year of the asset’s estimated service life. This results in a reasonably constant expense related to the asset because depreciation expense declines as repair expense increases.

Depreciation expenses are recorded for accounting purposes and its calculation is, therefore, important to a business. Depreciation is carried out for tangible assets which are the physical assets. A company acquires these assets to increase productivity and raise the overall performance of the business.

For the next accounting period that ends on 31 December 2021 (Year 2), the remaining useful life will be 3 years. For the Years 3 and 4, the remaining useful life will be 2 and 1 respectively. To use the sum of years, a calculation needs to be performed to determine the sum of years depreciation rate using the remaining life expectancy as the numerator and the sum of the digit number of years as the denominator.

For example, if an asset costs $1000 and has a salvage value of $200, its depreciation base is $800. It should be noted that the depreciation rate obtained with the formula above will sum up to 100% when adding the percentage obtained for each year. Once a company decides on a depreciation method it typically has to stick with that depreciation method going forward for that particular asset. Changing would require a revision of all previously submitted financial statements. Below is a break down of subject weightings in the FMVA® financial analyst program.

Based on the depreciation expense calculated for each year of the asset’s life in Step 4, calculate the depreciation amount that needs to be charged for each accounting period. We only need to calculate this value one time in an asset’s life when we estimate its depreciation for the first time. We will use the same value to calculate the depreciation expense of the future accounting periods. The-years’-depreciation is an accelerated method of depreciation that provides higher depreciation in the early years of the asset’s life and lower depreciation in the later years.